With the coronavirus, officially known as COVID-19, upgraded to global pandemic and confirmed cases in the United States spreading, many seniors are concerned about what type of Medicare coverage may be necessary to diagnose and treat possible cases of coronavirus. Here’s everything we know at this time about about COVID-19 for those on Medicare.

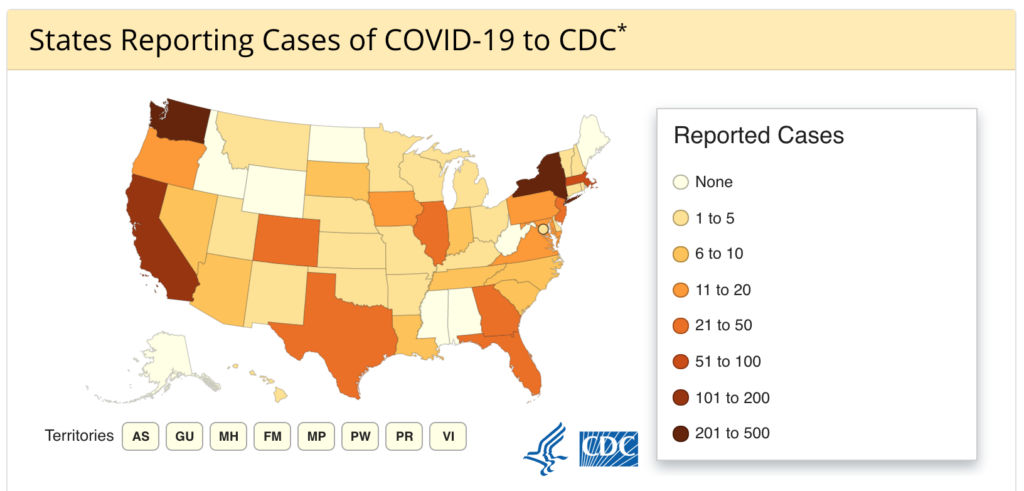

According to the CDC at the time of this article’s writing, domestic incidences of COVID-19 are as follows:

- Total cases: 1,215

- Total deaths: 36

- Jurisdictions reporting cases: 43 (42 states and District of Columbia)

What Insurance Covers Coronavirus Testing?

The coronavirus test is a blood test covered through Medicare Part B whenever a health care provider orders it, as of February 4, 2020. It should be fully covered with no out-of-pocket costs. People with Medicare Advantage are required to have the equivalent of Medicare Part B, so it should still be fully covered under these plans.

For people on any type of Medicare exhibiting flu-like symptoms lasting more than a couple days, this test is recommended to help manage the spread of the disease. In some cases identifying one’s illness as coronavirus early can help providers prescribe antiretrovirals targeted to the disease, though these are not always prescribed as there is no direct cure for the coronavirus.

Providers must wait until after April 1, 2020 to be able to submit a claim to Medicare for this test, so there may be some delay in coverage as the CDC, at the time of this article, is still deploying testing kits across the country and certifying the use of private labs for test processing.

What Insurance Covers Routine Coronavirus Treatment?

There is no vaccine or other specific treatment for COVID-19 at this time. Most treatment involves management of symptoms. Sometimes if caught early providers can prescribe anti-retrovirals. However, as with most flu-like illnesses, rest and fluids may be the best treatment for most people.

Avoiding going to public places other than to receive medical treatment can help slow the spread of the disease and keep others safe. For people who receive antiretrovirals or other treatment for COVID-19, it will mostly be covered by Medicare Part B. There may be some out-of-pocket costs associated with this treatment, though most treatment will involve staying home, drinking water and getting rest.

If severe symptoms continue beyond 2-3 days of a very high fever, contact a medical professional to determine whether a hospital stay or other intervention is necessary to prevent complications. This is especially true for at-risk populations such as people over the age of 60, smokers, people with heart disease or diabetes, people with existing respiratory issues and people who are immunocompromised for any reason.

What Insurance Covers Severe Coronavirus Treatment?

Severe cases of COVID-19 can lead to difficulty breathing and complications like respiratory infections and/or pneumonia. Antibiotics, IV fluids or supplemental oxygen may be needed to treat these cases. Sometimes a hospital stay will be necessary for people with severe shortness of breath.

For these people, Medicare Part A will cover hospital stays, a combination of Medicare Parts A and B will cover any antibiotics or supplemental oxygen prescribed to patients. Hospital stays for coronavirus are unlikely to extend longer than the number of hospital days covered under Original Medicare.

There may be out-of-pocket costs associated with an ambulance ride, hospital stay, prescription drugs or supplemental oxygen associated with treatment for severe coronavirus. In many cases, if referred by a physician to get tested for COVID-19, medical transport can be arranged by a quarantine or testing facility. This will depend on the nature of one’s individual Original Medicare, Medigap or Medicare Advantage plan.